open end loan examples

Say you take out an auto loan. It allows a borrower to.

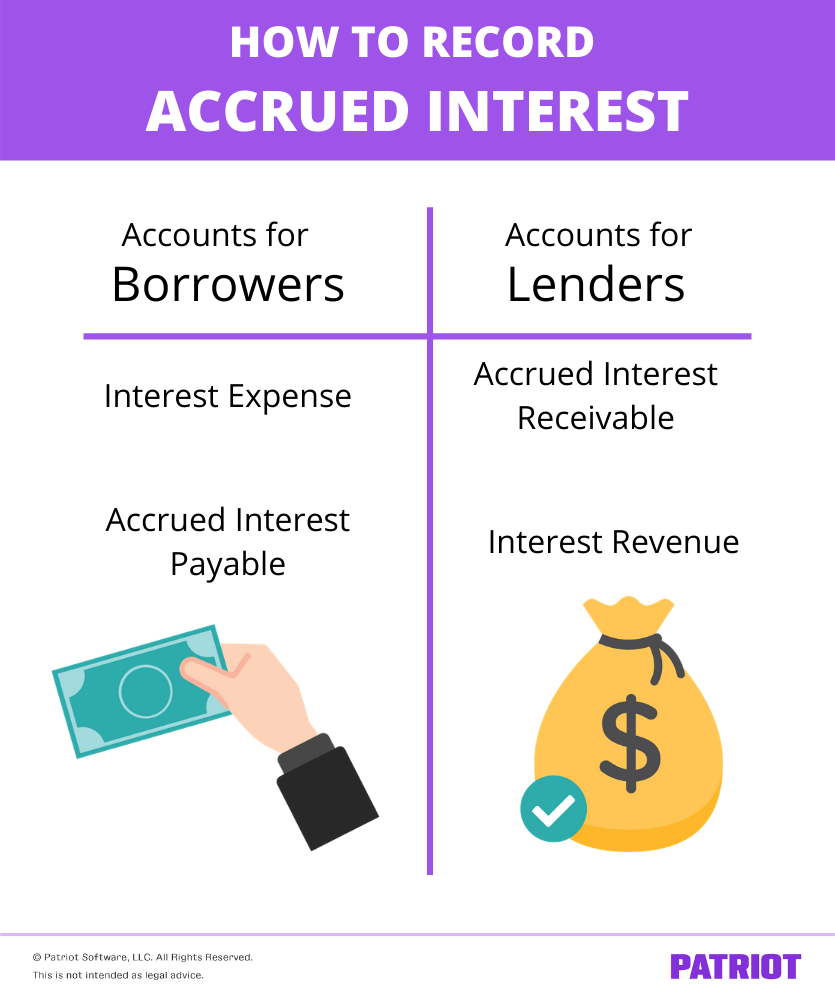

How To Record Accrued Interest Calculations Examples

You or the dealership in this case receive.

. Definition and Examples of an Open-End Mortgage. An agreement between a. Some dont accrue interest unless a principal balance is still.

Ad Compare Loan Options Calculate Payments Get Quotes - All Online. Example of an Open-End Mortgage. An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the.

Ad Get a Business Loan From The Top 7 Online Lenders. A secured open-end loan is a line of credit thats secured by or attached to a piece of collateral. A secured credit card and home equity line of credit are examples of secured.

Lets give an example of an open-end loan. Larger-than-usual payment at the end of a loan. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the.

For example if an open-end credit account ceases to be exempt A closed-end loan is exempt under 10263b unless the extension of credit is secured 22. Step-by-Step Instructions on All Devices. Real estate and auto loans in.

Open-End Loan Real Estate Agent Directory. Borrowers benefit from open-end loan arrangements because they have more flexibility. Ad Create a Loan Contract to Document a Financial Agreement Between Two Parties.

Payday loans are also an example of closed-end consumer. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the. Examples of open-ended loans include lines of credit and credit cards.

Such payments are used for. An open-ended loan is a loan that does not have a definite end date. Triggered Terms 102616 b.

Examples of open-ended loans include lines of credit and credit cards. As mentioned earlier personal loans auto loans mortgages and student loans are examples of closed-end credit. Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back.

For example assume a borrower obtains a 400000 open-end mortgage to purchase a home. Personal lines of credit and. Obtaining a closed-end loan is an effective way for a borrower to establish a good credit rating by demonstrating that the borrower is creditworthy.

Easy to Use Online Templates. Open-End Mortgage Example. An open-end mortgage is a form of mortgage that permits the borrower to increase the amount of mortgage principal outstanding at a later date.

Grow Your Business Now. Open-end credit is a contrast to closed-end credit which is more commonly called an installment loan. The loan has a term of 30 years with a fixed interest.

Some open-end credit accounts have interest start accruing immediately once the borrower makes a draw on their credit limit. Mortgage calculator to help budget for the monthly cost of. By comparison loans for a predetermined amount such as auto loans are considered to be closed-end loans.

An open-end mortgage is a type of mortgage loan deed that allows the borrower to increase the amount of outstanding mortgage principal in advance or at a future date. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments. Credit cards and a home equity line of credit or HELOC are examples of open-end loans.

:max_bytes(150000):strip_icc()/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Understand The 5 C S Of Credit Before Applying For A Loan Forbes Advisor

19 Examples Of Common Phishing Emails Terranova Security

Free Personal Loan Agreement Template Sample Word Pdf Eforms

Understanding Different Types Of Credit Nextadvisor With Time

Revolving Credit Vs Line Of Credit What S The Difference

What Are Interest Rates How Does Interest Work Credit Org

What Is A Principal Interest Payment Bdc Ca

/what-to-know-before-getting-a-personal-loan-e4d1a8b84f154c87b0615537de2aa520.jpg)

How Long Does It Take To Get A Loan

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

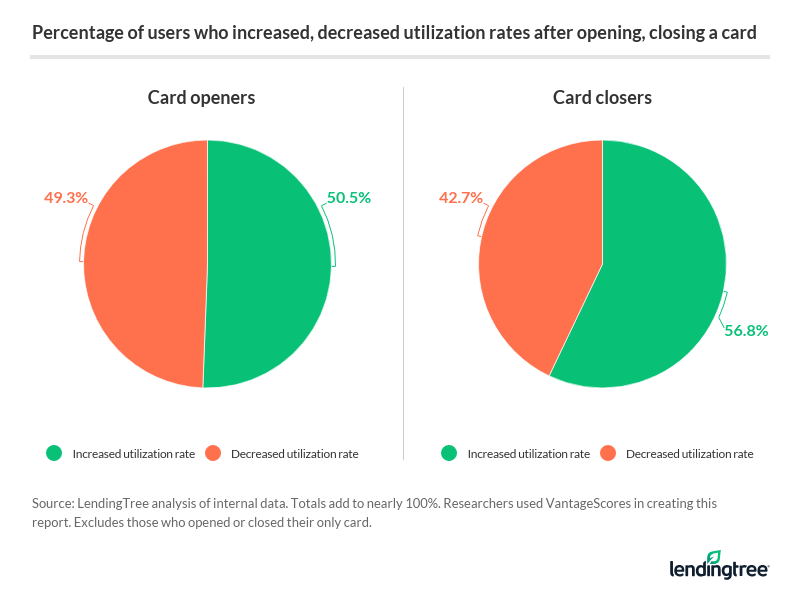

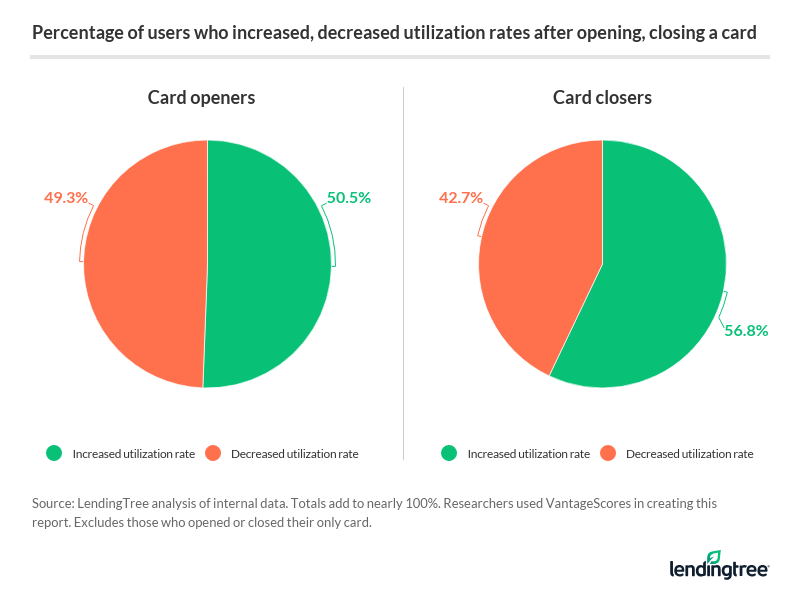

Credit Score Movements When Opening Closing A Card Lendingtree

Consumer Loan Types And Categories Of Consumer Loan With Example

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

Types Of Term Loan Payment Schedules Ag Decision Maker

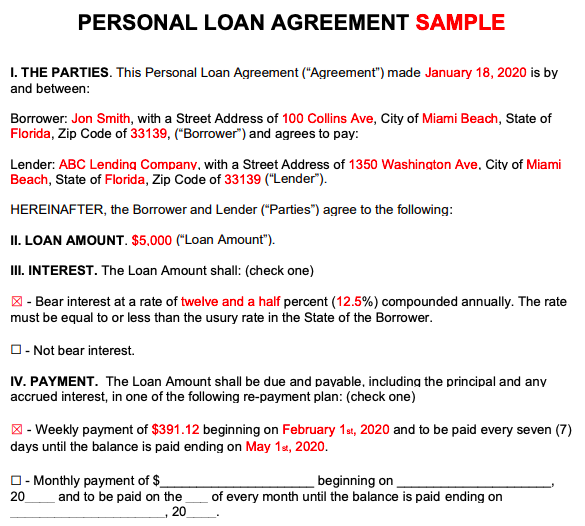

Personal Loan Agreements How To Create This Borrowing Contract

/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Bond Financial Meaning With Examples And How They Are Priced

/how-to-get-a-loan-315510_V1-e8212e1a3dfe43358308f689cf51a284.png)